carried interest tax uk

The carried interest tax charge is however deferred where the individual is genuinely unable to access the cash due to a commercial deferral arrangement which has been agreed with the external investors in the fund TCGA 1992 s 103KG2 and s 103KG13. Carried interest is a term used to describe the slice typically 20 of super profit profit in excess of a hurdle generated on alternative investment funds which is payable to the investment manager.

Basic Principles Of Investment Investing Lost Money Wealth Creation

In light of the news that a Labour government would crack down on the private equity industry by ending a loophole that allows executives to pay a reduced rate of tax on their bonuses Head of the Incentives Group James Paull examines the carried interest debate.

. The Tax Cuts and Jobs Act slightly curtailed the tax preference for carried interest requiring an investment fund to hold assets for more than three years rather than one year to treat any gains allocated to its investment managers as long term. Relief will only be available if the other tax paid is directly relatable to the carried interest amount received. The following Capital Gains Tax rates apply.

Carried interest is wholly IBCI if the relevant fund holds its assets for an average of 3 years or less. See recent article on UK Budget 2021 The rules on the tax treatment of carried interest are complex. Carried interest or carry is a share of any profits that the general partners of private equity and hedge funds receive as compensation regardless of whether or not they contributed any initial.

Legislation was published in the Summer Finance. The carried interest loophole allows private equity barons to claim large parts of their compensation for services as. An investment manager generally receives fees linked to the value of assets under management.

Gains from the sale of assets held three years or less would be short term taxed at a top rate. Carried interest is received by a UK resident company. Income Based Carried Interest IBCI which is subject to income tax and NIC and carried interest which is not IBCI which is subject to capital gains tax CGT.

Several Republicans denounced the current proposal. The carried interest is often structured so that the fund managers own an interest in the underlying fund so that the tax attributes of the. The introduction of the Disguised Investment Management Fees DIMF and carried interest rules in 2015 marked a great change in the taxation of carried interest for investment management professionals working in the UK.

Over 2015 and 2016 new rules relevant to carried interest were introduced that were designed both to reduce the scope for avoidance and to restrict the beneficial tax treatment. However specific rules the Disguised Investment Management Fee or DIMF rules prevent. Carried interest has increasingly come within HM Revenue Customs focus due to the potential risk of ordinary management fees being disguised as carried interest to avoid income tax.

From 6 April 2016 amounts of carried interest that arise from funds which do not hold their assets for 40 months or more can be classed as income based carried interest and will be charged to tax. In principle annual fees have been subject to income tax but carried interest and co-investment returns have been taxed as a capital gain at a lower rate of tax. This is intended to ensure that individuals pay at least the full rate of Capital Gains Tax CGT on their economic gain from carried interest.

And that planning. On current rates this results in an effective rate of tax of 47 per cent 45 per cent income tax and 2 per cent NICs on amounts which may previously have benefited from a lower rate of tax eg. The UK resident.

As a capital gain. 10 and 20 tax rates for individuals not including residential property and carried interest. 30 pages Ask a question Carried interest.

From 6 April 2016 carried interest will be taxed as UK source trading income rather. Closing the carried interest loophole is likely to be one of the thorniest sticking points in moving the Inflation Reduction Act of 2022 forward. The carried interest tax loophole is an income tax avoidance scheme that allows private equity and hedge fund executives some of the richest people in the world to substantially lower the amount they pay in taxes.

Tax Practical Law UK Practice Note 6-596-5847 Approx. James article was published in TheWealthNet 11 October 2021 and can. Carried interest now falls into one of two categories.

This measure will make the tax system fairer by ensuring that individuals to whom a gain arises in the form of carried interest are taxed on their true economic gain. Current law on the taxation of carried interest within sections 103KA to 103KH Taxation of Chargeable Gains Act TCGA 1992 was introduced by section 43 of Finance No2 Act 2015. Taxing carried interest which is not regarded as trading income at a minimum rate of 28 per cent.

Http Www Logicspice Co Uk Search Engine Optimization Services Marketing Techniques Seo Services

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics

Libro Offshore Gratis Cuenta Bancaria Sociedades Constitucion

220v 110v Nail Fan Acrylic Uv Gel Dryer Machine In 2022 Gel Uv Gel Dryer Machine

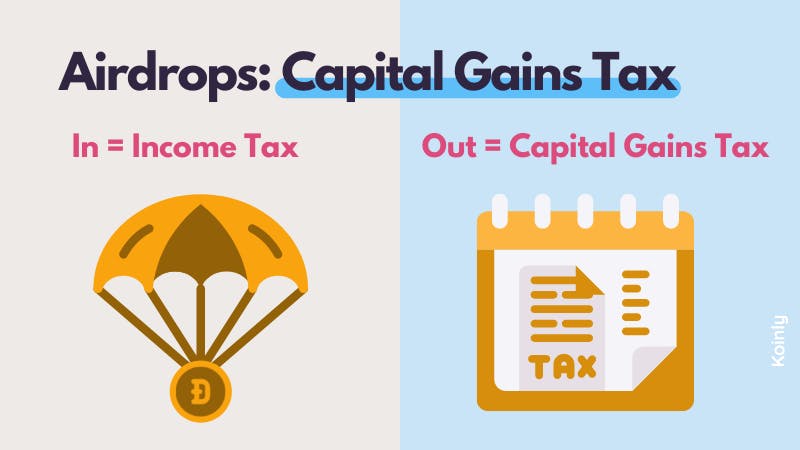

Crypto Tax Uk Ultimate Guide 2022 Koinly

Taxes On Money Transferred From Overseas In The Uk Dns Accountants Money Transfer Paying Taxes Blog Taxes

Sales Funnel Report Template Awesome Excel Sales Invoice Kobcarbamazepi Website Label Templates Card Template Business Card Template

Learn The Tips For Reducing Inheritance Tax Liabilities At Http Www Harleystreetaccountants Co Uk Top Five Tips For Reducing Inheritance Tax Liabilities

Bank Account Opening Services Kpc Corporate Bank Business Tax Kong Company

Crypto Tax Uk Ultimate Guide 2022 Koinly

How To Tax Capital Without Hurting Investment The Economist

Ed Sheeran Paid More U K Tax Last Year Than Starbucks Or Amazon Ed Sheeran Women S Plaid Shirt Womens Plaid

Financial Planning Services Irving How To Plan Wellness Design Financial

Things To Do With Your Tax Return Tax Refund Personal Finance Finance Advice

Pin On Money Saving Frugal Debt Free Budgeting

International Tax Attorney Matthew Ledvina Moves Into The Fintech Sector International Tax Attorney Matthew Ledvina Moves Into The Fintech Sector Tax Attorney Business Leader Matthews

1964 Austin Mini Cooper S Replica Fully Restored Expensive Upgrades Tax Exempt Mini Cooper S Mini Cooper Mini Cars

How Can We Afford The Freedom Dividend Dividend The Freedom Financial